tax management services zimbabwe

With trusted tax technology in place businesses can overcome these challenges and effectively manage sales and use tax to support growth. Manage and pay qualified personnel in your African enterprise complying fully with all local labour and.

Private Client Cross Border Tax Kpmg Canada

HR IR MANAGEMENT ZIMBABWE.

. CONTRACT MANAGEMENT SERVICES ZIMBABWE. Amendment to the definition of tax invoice and fiscal tax invoice. The withholding tax rate for both services and royalties is 10 but depending on the tax treaty between Malaysia and the respective countries the rate may be further reduced.

Deloitte Touche Zimbabwe is a part of Deloitte Africa. Government imposes user charges to be. Fast easy accurate payroll and tax so you save time and money.

With Thomson Reuters myPay Solutions you can offer your clients easy and efficient payroll services without the liability or hassle of processing payroll yourself. Gasoline purchased with cash is not tax exempt. Small Business Payroll 1-49 Employees Midsized to Enterprise Payroll 50-1000 Employees Time Attendance.

Sales tax exemption cards may not be used to purchase gasoline tax-free. Fast easy accurate payroll and tax so you save time and money. Section 2 and section 20 of the Zimbabwe VAT Act will be amended.

EXPATRIATE. In the Republic of Zimbabwe Deloitte operates as Deloitte Touche Zimbabwe. Checkpoint Comprehensive research news insight productivity tools.

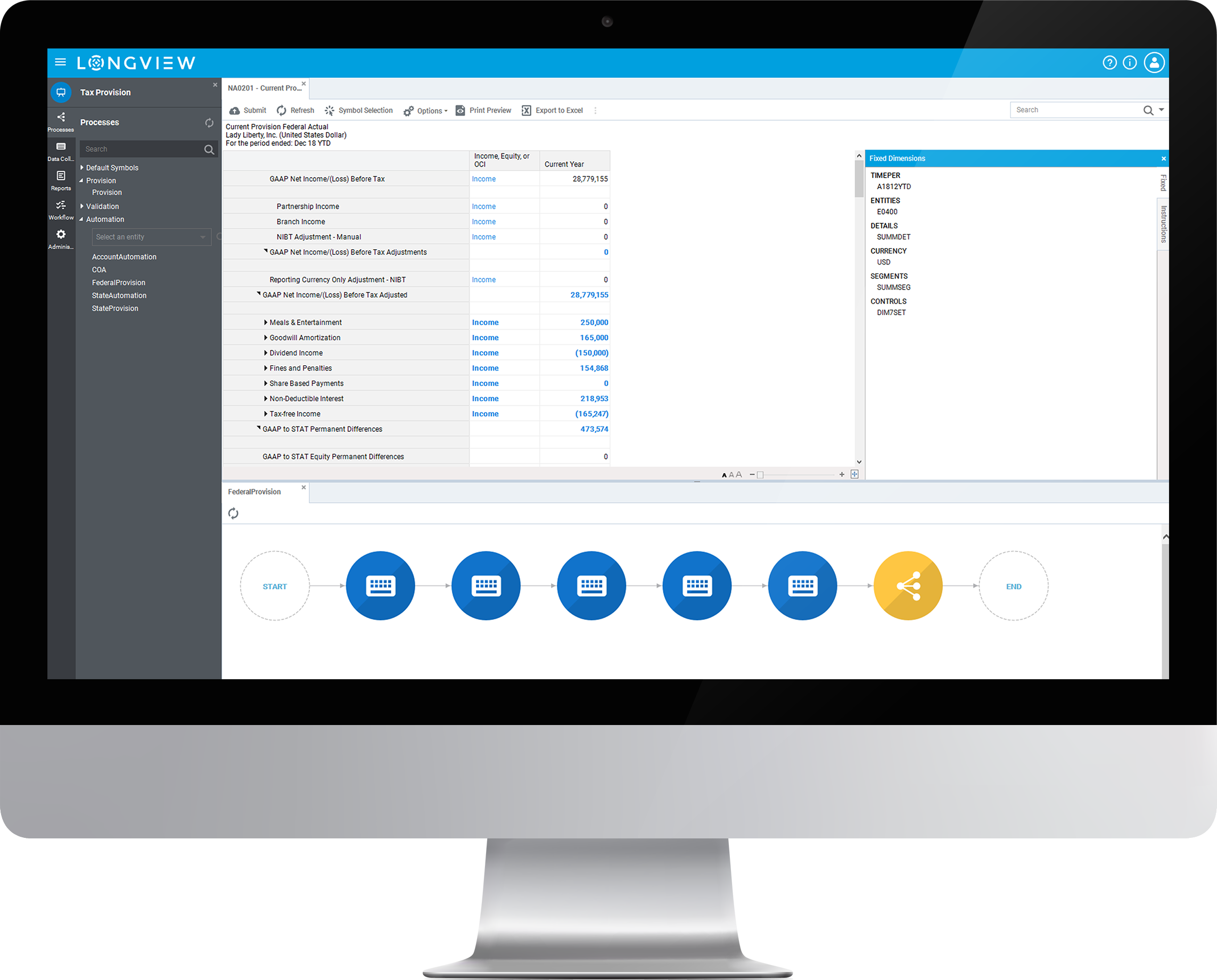

Accounting Standards Codification ASC 740 Income Taxes addresses how companies should account for and report the effects of taxes based on incomeAccounting for income taxes can be challenging as companies navigate the rapidly transforming global tax environment changing business. Individuals who wish to claim exemption described below must present a copy of their diplomatic identification card andor their A-1 A-2 G-1 G-2 G-3 or G-4 visa when purchasing airline andor cruise tickets. EMPLOYER OF RECORD SERVICES ZIMBABWE.

Midsized to Enterprise Payroll 50-1000 Employees. Small Business Payroll 1-49 Employees Compare Packages. Economic trends changing nexus regulations and increasing audit activity has made sales and use tax management a complex task with increasing risk.

Small Business Payroll 1-49 Employees Midsized to Enterprise Payroll 50-1000 Employees Time Attendance. AFRICAN PAYROLL SERVICES ZIMBABWE. Malaysia has signed tax treaties with over 75 countries including most countries in the European Union the United Kingdom China Japan Hong Kong Singapore Australia.

We have summarised the key fiscal highlights from the 2022 Budget Statement the draft Finance Bill. The presentation of a tax exemption card is not required to receive this benefit. Fast easy accurate payroll and tax so you save time and money.

Gasoline Tax Exemption A gasoline tax exemption may be extended to missions and mission personnel by means of tax-exempt oil company credit card accounts. About Deloitte in Zimbabwe. Explore our full range of payroll and HR services products integrations and apps for businesses of all sizes and industries.

America Uruguay Uzbekistan Venezuela Vietnam Zambia Zimbabwe eSwatiniSwaziland. Explore our full range of payroll and HR services products integrations and apps for businesses of all sizes and industries. CS Professional Suite Integrated software and services for tax and accounting professionals.

Türkiye Uganda Ukraine Україна United Kingdom UK United States US USA US. On 10 December 2021 the National Assembly of Zimbabwe approved the 2022 Budget. Implementing a streamlined payroll processing partnership with a trusted advisor like Thomson Reuters enables you to empower your staff focus on client relationships and enhance.

Wealth management tax services. The Group Tax Review is a process that is designed to assist you in identifying the key domestic and international tax attributes of your corporate group with a view to reducing potential tax risks and exposures minimising tax costs and creating value through the development and implementation of relevant tax management solutions. Onvio A cloud-based tax and accounting software suite that offers real-time collaboration.

Explore our full range of payroll and HR services products integrations and apps for businesses of all sizes and industries. Neither formal diplomatic accreditation nor entitlement to general sales tax exemption. Delivering tax services insights and guidance on US tax policy tax reform legislation registration and tax law.

Take advantage of automated tools and outsourcing. Financial accounting and reporting for income taxes. Deloitte Africa is a member of Deloitte Touche Tohmatsu Limited DTTL a.

Corporate Tax Compliance Software And Solutions Sap Concur Canada

Business Tax Software For Tax Professionals Insightsoftware

Pwc S Approaches And Solutions For Overseas Business Pwc Japan Group

Kpmg Managed Services Kpmg Global

Property Taxes Haldimand County

Patrick Rood Owner Rood Financial Services Linkedin

Managing Your Personal Taxes 2021 22 A Canadian Perspective Ey Canada

Private Wealth Tax Planning Pwc Channel Islands

Business Tax Software For Tax Professionals Insightsoftware

Legal Managed Services Nrf Transform Global Law Firm Norton Rose Fulbright